When making important business decisions, it’s best to be well-informed. In addition to feeling more confident in your choices, knowing the latest trends and developments in your industry will allow you to strategize and set realistic expectations as you scale your company.

Awareness of notable figures in the eCommerce space will help you plan for success as you head into the future. Having data on hand is especially useful for those that run eCommerce businesses. Given that the Philippines’ eCommerce revenue is estimated to reach $22.9 billion in 2023, knowing the right approach makes sense from a business perspective.

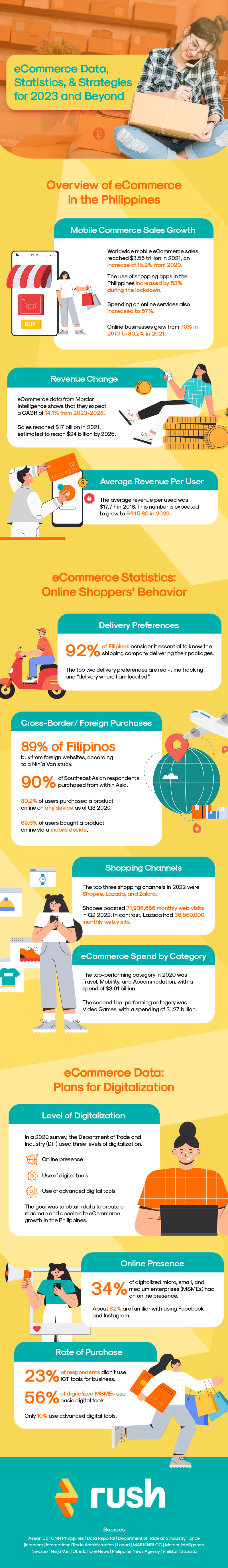

Grow your knowledge to form effective eCommerce strategies through the statistics shown in the infographic below.

Overview of eCommerce in the Philippines

Several notable statistics show how powerful eCommerce has become in the Philippines. These are mobile commerce sales growth, revenue changes, and average revenue per user.

Mobile commerce sales growth

The number of mobile phone users for shopping has risen drastically in recent years. A 2022 report noted that mobile eCommerce sales worldwide reached $3.56tn in 2021, an increase of 15.2% from 2020.

While the Philippines is small compared to consumer titans like the US and China, a boom in the local eCommerce industry during the pandemic acquired significant numbers. Mobile shopping increased to 53% during the lockdown and saw a 57% rise in spending.

In response to the surge, more businesses shifted online. As a result, the online retail sector saw an 80.2% increase in 2021, a significant growth from 70% in 2019. Even in a post-pandemic environment, experts still expect these numbers to increase.

Revenue change

eCommerce in the Philippines continues to grow after COVID-19 lockdowns. Studies show that the country’s market is expected to grow at a CAGR of 14.1% through 2023-2025.

From $17bn in 2021, it’s estimated that this development will reach $24bn by 2025. One factor contributing to the growth is how many users use the internet. Over 67% of the country’s population is online and typically spends 10 hours and 56 minutes browsing.

Average revenue per user

Pre-lockdown revenue per user was relatively low at an average of $17.77 in 2018. However, that number has drastically increased since the lockdown and is expected to total $445.80 in 2023. One of the reasons for the surge was the Philippines’ basket size in 2020 (57%), beating out all the other Southeast Asian countries.

eCommerce Statistics: Online Shoppers’ Behavior

Understanding the trends in customer behavior is a critical deciding factor for your business. Here are some of the notable eCommerce statistics regarding online buyer activities.

Delivery preferences

In 2022, the courier service Ninja Van surveyed 9,000 respondents across six Southeast Asian countries regarding their delivery preferences. They found that 89% of responders consider it essential to know who is delivering their packages.

Furthermore, 92% of the Filipino respondents echoed this sentiment, with many sharing that knowing the company reassures their confidence in parcel handling.

The survey also shows the top two delivery preferences. Five of the six countries, including the Philippines, had “real-time tracking” as the top choice. Four countries chose “delivery where I am located” as their runner-up, indicating that convenience was essential for deliveries.

Cross-border/foreign purchases

The same Ninja Van study also delved into foreign purchasing behavior. It presented that 89% of Filipino respondents purchase from foreign websites but are likely to buy a second time. The Philippines had the lowest engagement rate (48%) out of the six countries, with the other five having rates over 60%.

It’s also interesting how 90% of respondents purchased from other Asian countries as opposed to Europe and the US, with most of these goods coming from China.

Rate of purchase

The rate of purchase, or conversion rate, refers to the percentage of users that buy a product after visiting a store. We Are Social and Hootsuite’s 2021 partner study examined internet users aged 16-64 and their online activity.

They reported that in Q3 2020, 87.8% of Filipino users visited an online store on their devices, with 85.7% using their mobile phones. In addition, conversion rates were high, as 80.2% of users made purchases via a device, with 69.6% making purchases through their phones.

Since the pandemic, online shopping seems to have become the country’s new normal.

Shopping channels

eCommerce data also shows which shopping channels Filipinos prefer to browse. As of June 2022, 86% prefer using eCommerce marketplaces such as Shopee, Lazada, and AliExpress. Of all marketplaces, the top three performers in Q2 2022 were Shopee, Lazada, and Zalora.

During this period, Shopee boasted 71,936,666 monthly web visits. In contrast, Lazada had 36,550,000 monthly web visits, less than half of Shopee’s.

eCommerce spend by category

We Are Social and Hootsuite’s report also showed what products customers were buying the most in 2020. The top-performing category was Travel, Mobility, and Accommodation, with an eCommerce spend of $3.01bn. The high number of purchases could result in many borders opening after the pandemic, allowing users to travel freely again.

The second best performer was Video Games, with a spend of $1.27bn. It could be due to the increase in video gaming during the pandemic, with Newzoo predicting that the market will surpass $200bn by 2023.

The worst performer was Digital Music, with $23.48mm. The lack of purchases may stem from free music streaming services like Spotify being widely available.

eCommerce Data: Plans for Digitalization

The Philippine government is also taking an interest in the eCommerce boom. In 2020, the Department of Trade and Industry (DTI) looked at the digitalization levels of micro, small, and medium enterprises (MSMEs) within the National Capital Region, Region III, and Region IV-A.

Many MSMEs had low digitalization, with 23% not using ICT tools for business. Meanwhile, 56% of MSMEs used basic digital tools like Microsoft Office, email, and mobile phones, whereas only 10% had advanced tools like ERP, CRM, and analytics.

Only 34% of the digitalized businesses had an online presence, though 82% of the respondents were familiar with eCommerce platforms like Facebook and Instagram.

Using the data, the DTI hoped to accelerate the growth of eCommerce in the country through their 2022 Roadmap. With their list of agendas, their goals are providing accessible ICT services to MSMEs, funding eCommerce innovations, and increasing the number of enterprises.

Strategy and Thought, Tactics and Observation

As Dutch chess player Max Euwe said, “Strategy requires thought, tactics require observation.”

The eCommerce market is a battlefield, and making informed decisions will help your business grow in 2023 and the coming years. Observing the different trends lets you see which tactics are working and help you think of effective strategies to capture the market.

If your business is at its early stages, look to RUSH for eCommerce solutions that help you get off the ground. We’ll help you set up your online storefronts (like a website store, your own sales app, or a marketplace store) through the RUSH eStore, and educate you on engaging customers through our built-in modules.

Get in touch with an expert and book a demo today with RUSH.

Creative Manager at RUSH Technologies

Kent Marco is a Creative Manager at RUSH Technologies - the go-to e-commerce services partner of every business in making digital easy, efficient, and effective in the Philippines. He has a solid experience in the field of Creatives and Advertising particularly in Visual Effects, Motion Graphics, Art Direction, Graphic Design, Sound Design, and Web design. His pastimes include managing a family business, composing and publishing songs, and staying up to date with the latest technological innovations and creative design trends.

Kent Marco

Creative Manager at RUSH TechnologiesKent Marco is a Creative Manager at RUSH Technologies - the go-to e-commerce services partner of every business in making digital easy, efficient, and effective in the Philippines. He has a solid experience in the field of Creatives and Advertising particularly in Visual Effects, Motion Graphics, Art Direction, Graphic Design, Sound Design, and Web design. His pastimes include managing a family business, composing and publishing songs, and staying up to date with the latest technological innovations and creative design trends.